The Definitive Guide to Personal Loans Canada

Table of ContentsTop Guidelines Of Personal Loans CanadaSome Known Incorrect Statements About Personal Loans Canada Rumored Buzz on Personal Loans CanadaHow Personal Loans Canada can Save You Time, Stress, and Money.Personal Loans Canada Can Be Fun For Anyone

Doing a regular budget plan will certainly give you the self-confidence you require to handle your money efficiently. Great points come to those who wait.Conserving up for the large points means you're not going into financial debt for them. And you aren't paying much more in the future since of all that rate of interest. Depend on us, you'll enjoy that family members cruise ship or play ground collection for the youngsters way extra knowing it's already paid for (rather of paying on them till they're off to university).

Absolutely nothing beats peace of mind (without financial obligation of course)! You don't have to transform to personal financings and financial obligation when things obtain tight. You can be totally free of financial debt and start making genuine traction with your cash.

A personal financing is not a line of credit rating, as in, it is not rotating financing. When you're approved for an individual finance, your lending institution gives you the complete amount all at as soon as and then, normally, within a month, you begin repayment.

Personal Loans Canada Fundamentals Explained

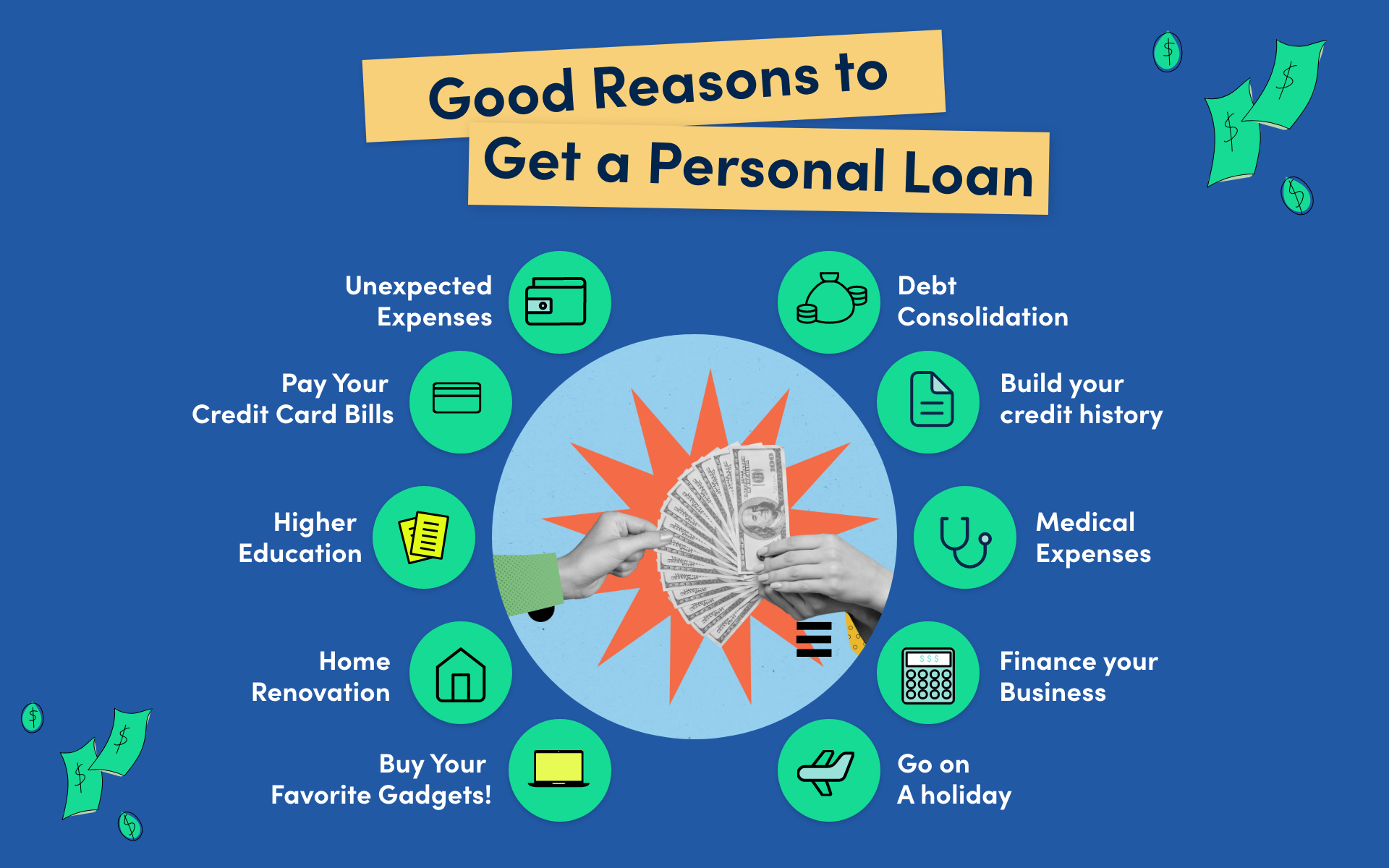

A common factor is to consolidate and merge debt and pay all of them off at the same time with an individual car loan. Some banks put specifications on what you can use the funds for, however several do not (they'll still ask on the application). home improvement fundings and remodelling lendings, financings for moving costs, getaway car loans, wedding celebration fundings, clinical lendings, automobile repair car loans, finances for rental fee, little auto loan, funeral loans, or various other costs repayments as a whole.

The need for personal finances is climbing amongst Canadians interested in running away the cycle of payday car loans, settling their financial obligation, and reconstructing their credit rating score. If you're using for a personal car loan, below are some things you ought to maintain in mind.

What Does Personal Loans Canada Mean?

In addition, you could be able to lower just how much overall rate of interest you pay, which suggests more cash can be conserved. Individual fundings are effective tools for developing your credit rating. Payment history make up 35% of your credit rating, so the longer you make regular settlements in a timely manner the a lot more you will see your rating increase.

Personal lendings provide a wonderful possibility for you to reconstruct your credit history and repay debt, however if you do not budget plan appropriately, you could dig yourself right into an also much deeper hole. Missing out on one of your month-to-month settlements can have a negative impact on your credit history yet missing several can be ruining.

Be prepared to make each and every single repayment on time. It's real that a personal funding can be made use of for anything and it's much easier to obtain approved than it ever remained in the past. But if you do not have an urgent need the additional money, it could not be the finest remedy for you.

The fixed regular monthly settlement quantity on a personal lending depends upon just how much you're borrowing, the rates of interest, and the set term. Personal site link Loans Canada. Your rate of interest will certainly depend on factors like your credit history and income. Commonly times, individual finance prices are a whole lot reduced than charge card, however often they can be higher

Some Known Facts About Personal Loans Canada.

The marketplace is great for online-only lending institutions loan providers in Canada. Rewards consist of terrific rates of interest, incredibly quick handling and financing times & the privacy you may want. Not everybody likes strolling right into a financial institution to request cash, so if this is a difficult place for you, or you just don't have time, considering on-line lending institutions like Spring is a great choice.

Repayment lengths for individual financings normally fall within 9, 12, 24, 36, 48, or 60 months (Personal Loans Canada). Much shorter settlement times have really high regular monthly settlements but after that it's over promptly and you don't shed more cash to interest.

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)

The Buzz on Personal Loans Canada

You may obtain a lower interest price if you fund the finance over a much shorter period. An individual term finance comes with a concurred upon payment routine and a taken care of or floating interest price.